What Exactly Is So Special About The Iphone?

Accessing and building your social network is easier than ever with an iphone. But, many people do not know how to use these features. Never fear; this article will help you use your iphone in the best way possible.

Dry out your wet iphone with uncooked white rice. Nearly everyone has dropped a phone in a puddle, sink or even a toilet. Rather than using a blow dryer, softly wipe the phone and submerge it in a plastic ziptop bag with plenty of rice. Let it dry overnight.

To conserve battery life, reduce the brightness of your iPhone's screen. Simply go the settings option on your iphone and select the brightness option. At a lower brightness, you'll find your iphone lasts for a lot longer. This is especially helpful if you know you are going to go a long time between charges.

When using Safari, it only takes a single tap to place a phone call. Let's say you want to find a dry cleaner. Upon finding the phone number on the website, you don't need to open your phone app to call. Simply tapping the number will connect you to the phone number that you desire to reach.

Consider buying a screen protector for your iPhone's screen. You can shield your phone's screen from the scratches and nicks that are common with regular use. The screen is very sensitive, so this barrier will serve as a valuable shield. Therefore, a screen protector is an essential accessory.

Hitting the "X" button when the AutoCorrect suggestion box comes up is not necessary. To eliminate this alteration, tap anywhere else on the screen. This will close the suggestion box for you, which is a much faster method.

Are there special characters such as umlauts or accents that you would like to use in your texts? If so, then listen carefully. Touch the letter you want to change, and hold it for a bit. A box that contains extra keys should pop up. You'll have access to a complete range of special characters this way.

Tag email account on the iphone so that you can quickly get to your messages. By tagging these accounts, you will receive a notification any time you receive an email. This will allow you to view your messages in a timely manner. Your phone can handle several email accounts.

Did you just type something into iMessage that you probably shouldn't have? Have you ended up with something strange added to your message by Auto Correct? Giving your iphone a swift rattle is a really simple way to fix this. That undoes any recent typing. Go to your Settings and make sure this feature is enabled since it is an optional one.

One of the most beloved features of the best mobile phone insurance iphone is the ability to take pictures. It can be hard to sort through pictures after taking them. Use the iPhone's built-in album feature to keep your photos organized and easy to find. This will really speed you up when you need to locate a particular picture.

You probably know very well that you can get rid of your iPhone's word suggestions when you're composing text by hitting the "X" in the suggestion box, but there's a faster way to do it, too. Just tap the screen anywhere to cancel the suggestion box.

If your iphone ever freezes, and the Sleep/Wake function does not work, try doing a manual reset to see if it helps. Simply depress the button as you hold the Home button. The phone will shutdown and restart in order to signal everything went well.

There are several ways to go about using the camera application on your iphone. Just use the volume control that is on the cord of your headphones. Begin by keeping your hand steady on the subject you're capturing. You simply press one of the volume buttons on your headphone cord to snap a photo.

After you link all the social media accounts on your phone, you will feel more connected to everyone on different social media sites. By using this information, you can stay in touch with your family and friends all the time. iPhones have always been in the forefront of the social media world, so stay connected the easy way.

Expert Insurance Help Anyone Can Take Advantage Of

There are lots of different types of policies. It's insure mobile phone easy to get confused about all of them. The article below will give you tricks and tips to help you understand what insurance you need and where to get the best deal.

To help you get a discount, you should consider purchasing your insurance policies from a single company. The most common bundle you will come across is discounted home and auto insurances sold together. As you compare your options, inquire about discounts and reduced rates for policy holders who take out both auto insurance and homeowners insurance.

Search for multi-policy deals from insurance companies. Buy car insurance and motorcycle insurance together to secure a fixed rate. You should also investigate whether you can get homeowner's or renter's insurance through the same company that you get your vehicle insurance through. Also, if you have both homeowner's insurance and flood or fire insurance, see if you can bundle these insurances. Make sure to only purchase insurance that you must have.

To make sure any insurance claims you make go smoothly, take the time to document every step of the process. Take notes over every interaction you have with your insurer so that you can track claim status. After having face to face talks or phone calls, write letters to confirm what you were verbally told.

Go online and use that to your advantage when searching for insurance quotes. This will help you to have a better idea of the range of options available to you. Any quote online will generally be subject to detailed application and medical exams.

If you choose to raise your deductible, it can cause your premiums to lower, but it can be risky, too. While you have the advantage of lower monthly premiums, you are going to be fully responsible for small incidents. Be mindful of how much these minor costs can add up, so you can make an informed decision.

Finances must be policed properly in every aspect of life and one of those huge aspects involves your auto insurance. If you pick one with a lower deductible, you pay a larger upfront cost, but you're completely protected in an accident. If you have a high deductible you are taking a chance that nothing bad will happen, but you get a much lower payment each month.

There are a number of places to look to find the best deals for insurance. Shop on the Internet and do your homework first. Make sure that you are educated on insurance providers and what plan is best for your needs. The more insurance knowledge one has will make it easier to get the right insurance plan.

Read your renewal forms on pet insurance carefully every year. In some cases, insurance companies look at renewals as a new beginning, and conditions your pet has recently developed could fall under the "preexisting condition" category. These tactics are used by disreputable insurance agencies, so be aware of them, and beware of them.

Every year you should look over your insurance and make sure it still reflects your current needs. For example, it may no longer be appropriate to carry collision coverage on an older vehicle. You might also find other opportunities for additional savings. Adjust your policy to reflect your needs.

Consult your state insurance agency to find useful information about current or prospective insurance carriers. Because state governments regulate insurers, they keep detailed records of premium increases and complaints filed against particular insurance companies. Whenever a company increases its premium rates, it has to notify the state and justify the hike. Go on the Internet where you can find public records from the insurance companies.

Shop around for the best possible price on insurance coverages. There are a lot of sites online that will provide you with insurance quotes for free, and they might also compare companies to each other based on criteria that you give them.

It can sometimes be difficult to navigate the world of insurance, but hopefully this article has helped you to have a better understanding about what you truly need. You will also be able to obtain a better bargain if you are more knowledgeable, so keep all of this advice in mind when you go shopping for insurance.

Get Great Deals When Shopping Online Today!

Have you experienced the ease of online shopping from your bedroom? How about finding those hard to find items without making trips to several different stores? This is quite possible. Purchasing online can take the hassle out of shopping.

Read the terms and conditions and privacy policy of a new online retailer before shopping. This includes how they use your information, how they protect it and what your responsibilities are as a shopper. If you do not agree with something in these policies, you should contact the merchant before buying anything. Don't purchase things from places that you don't agree with.

When shopping online, it's best to shop around to find the best price. Making purchases online is a great way to get the best possible price. As you compare your options from different retailers, avoid perusing sites that you feel you cannot trust. It is never worth the risk to purchase from an unknown site simply to get a bargain price.

Proceed with extreme caution when volunteering your personal information to an unfamiliar online retailer. You need to look out for signs like Cybertrust and Verisign so you can ensure retailer credibility.

Try being patient instead of overpaying for expedited shipping options. You may be amazed by the speed with which your items will arrive just with standard shipping. The dollars saved can be put to use in subsequent shopping sessions.

Many websites devoted to shopping can provide a great deal of information that can help you make smarter buying choices and avoid guilty feelings. On these sites you can find customer reviews about the product.

Avoid making any purchases you really do not need right now until certain holidays. Holidays can be big for sales and deals, even on the Internet. You can find discounts, free shipping and other great deals.

You shouldn't be paying the retail price when purchasing a product online. Retailers often stick to a schedule when they advertise sale items. By waiting for the item to go on sale, you can save between 10 and 50 percent off the retail price. Just be patient to save money.

Prior to shopping online, search sites offering coupons, such as coupons.com. Both manufacturer and retailer coupons can be found, which can help you save a lot of money. Just be sure you don't forget to look them up prior to shopping.

When setting up any passwords related to online shopping, it is important that you take it seriously. Don't use words that are simple or phrases either. Online shopping accounts have your financial information, so you have to be especially careful. Do not make it simple for anyone to take advantage. Use random passwords that are comprised of different symbols, letters, and numbers.

When you use several different shopping sites, you might be tempted to use a single password for them all. However, this is not a good idea. Instead, you should create different passwords for each retailer to ensure that your security is maximized. If you think you may have trouble remembering your passwords, store them in a secure location.

Any time you shop online, be sure to review the store's return policies. You need to be aware of what it will take to return an item if it doesn't fit or something is wrong with it. If no returns is the policy, and you purchase something, you're stuck with this mobile phone insurance unusable item.

Look for HTTPS in the address bar before giving personal information or payment information. The S stands for security encryption, letting you know that your information is secure. Look for a padlock sign on any shopping site you plan to make a purchase from.

If you want to maximize your savings, consider joining a few shopping forums. That way, you'll get alerts from people who are also looking for great deals. This points you toward deals you would not have discovered otherwise, so put forums to work for you.

Don't give any shopping website access to any social security numbers. Be suspicious of a site that asks for this information. Your SS number is never a requirement to buy online. It is not safe to enter that information online.

Having read this article, you likely have a good comprehension of shopping online. There are many fun items to find that you may not have otherwise. Apply these useful recommendations to track down and purchase everything from antiques to zoology books.

Useful Online Shopping Tips You Won't Read Anywhere Else

It is not necessary to leave your home in order to shop these days. Instead, you can buy from the comfort of your own home. No more going out in bad weather, dealing with the crazy shoppers that fill the stores or overspending on something you have to have. Keep reading for tips and tricks to help you shop online.

Read a store's policies before you make a purchase for the first time. This will explain the information collected by them, the ways they protect it, and what you're agreeing to when you buy something from them. If you're not sure of something or don't agree with it, then you need to contact them before you purchase something. With the competition on the Internet, you should not shop with a site that follows shady policies.

Before you shop online, be sure that your computer is loaded with the latest antivirus software. There are many dangerous sites out there trying to lure you in. There are those who offer deals that are too good to be true just so they can spread malware to your computer. Even if you think a retailer is reputable, you should still take precautions.

Lots of online stores give discounts to those using coupon codes. These codes are easily found online by entering the words "coupon code" along with the manufacturer or name of the website you will be buying from. You could get anything from no-cost shipping to a discount percentage dependent on what is being offered at the time, so it is well worth the time spent searching.

If you plan to shop online, be sure to use a secure connection every time. Otherwise, you make yourself vulnerable to hackers who prey on those using public connections.

Find sizing charts on any clothing site you use. A big challenge when it comes to clothes shopping online is the fact that it is tough to know whether things will fit. But most online stores have size charts that can be used to determine the proper fit and size to buy. These can come in very handy!

Narrow your results by using a shopping search engine. While the big general search engines will certainly provide you with lots of information, the total volume of search results may be overwhelming. You'll be taken directly to commercial sites that are selling the things you want to buy if you search through shopping-focused sites such as ShopStyle.com.

Read the product description carefully for any item you purchase. Look at the specifics, the size of the item and make sure it comes with the features you need. Sometimes the picture featured is not the exact model being sold.

Look for online sellers who offer live chat assistance. Such live help options allow you to get answers in real time. Additionally, you could be able to negotiate a better deal by using Live Chat. Some will be happy to oblige if you order from them on that same day.

When you shop through the Internet, try to make purchases that are not necessary right at the moment around holidays. The best deals are found during various holiday weekends. You can find discounts, free shipping and other great deals.

Understand clearly the return policy when making a purchase online. You don't want to get stuck with something you hate but can't send back.

Keep your tax liability in mind. You probably won't have to pay taxes, but if the shop is out of state, the rules are different. If you are both in the same state, you have to pay sales tax on purchases. You may not see that charge pop insurance for mobile phones up until your credit card is charged, however.

You should never make an online purchase with an email that you use frequently. Sadly, you may get spam after buying online. Set up a special e mail address for shopping only. Your inbox will be cleaned up while you still get important messages.

Search for promo codes before you shop. You may find savings, free shipping or age-appropriate discounts are on offer at the website of your choice. You can save lots of money by researching best prices before buying.

After reading this advice, you can find some great deals online. Your new purse, shoes and earrings are one click away! You can start shopping right away, and make sure you don't forget anything you have just learned.

Take Your Cell Phone Abilities To New Heights With These Tips

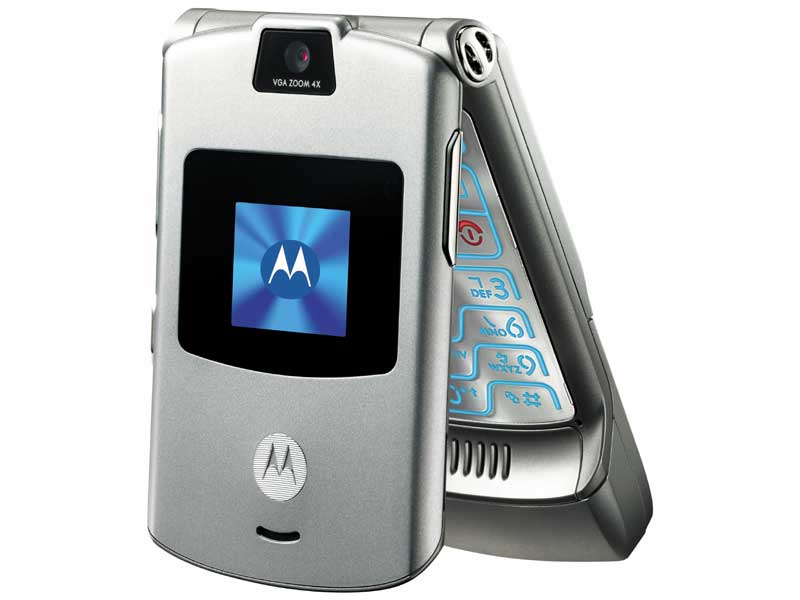

To keep up with modern technology, a good cell phone is key. You need to do your research, no matter if you want a new phone or you have to fix the one you already have. Continue reading for great cell phone advice.

If you phone gets wet, it isn't necessarily beyond repair. Take the battery out and place the cell phone in a plastic baggie filled with insure mobile phone rice. This facilitates absorption of moisture that has gotten in your device.

Remember that age will slow down a smartphone. Updating software can help to keep the phone running. Most new phones have updates that are more powerful. In a couple years, the upgrades might not work on the older phones.

It is likely that your smartphone is on for most of your waking hours. Make sure you turn it off here and there. Smartphones are similar to computers. Restarting them can free up the memory and keep them running better. You will see a glaring difference immediately.

Extended warranties can be tricky. Generally, these added costs are nothing more than that. If they are going to occur, problems with a cell phone are likely to show up in the first year while the basic warranty is still in effect. Additionally, lots of people replace their cell phones every year, so why buy an extended warranty?

Cell phones get slower with age. Thus, you might find it harder and harder to update the phone's software. This will maximize the potential of your phone. You have the option of keeping things as they are by not accepting updates, or you can upgrade the phone to stay on top of changes.

Do not invest in a smartphone unless you are certain of your needs. Though smartphones can be pricy, you get what you pay for. That said, most people don't need those features. If you are among them, getting a smart phone just means additional expense initially and on a monthly basis. This may make little sense.

If you've got a newer phone, you may not need that expensive case to go with it. A hard material such as Kevlar or a carbon fiber is typically used by smartphone designers when the phone is built. Although cases can protect what's there, they can make it harder to use the cell phone. Learn about your phone and decide if your phone needs a case or not.

Your cell phone's camera doesn't use an optical zoom. For an up close view, you must move closer. You can purchase lenses that do this also.

It can be wise to upgrade your phone fairly often so that you take advantage of new technology. New cell phones use the latest technology, and a lot of websites utilize their top of the line processing power. You may not be able to visit these sites if your phone is outdated.

Make sure your cellphone is protected. They may be expensive to replace or fix. Purchase a good screen protector to keep your screen from getting scratched. Additionally, a hard case will protect your phone against drops and dings.

Purchase a solid case to protect your phone. Dropping many high-end phones can cost you quite a bit. You could look for extremely strong cases from Otterbox if you are truly concerned. One really good case is called the Defender.

Be sure to learn how the calendar function works on your phone. It will help you keep your schedule up to date and organized. You can have the phone alert you before the event so that you are always prepared. This really helps people organize their lives without having to take time to write things down on paper.

Do not be misguided by cell phone's zoom lens. The traditional optical zoom that cameras use is not the same zoom for cell phones. Instead, you'll get a digital zoom. This enlarges pixels, and it can lower the overall quality of the zoomed-in photo. Moving closer to an object is the only real way to get a closer shot.

You have to have a good cell phone today. Your phone's battery life, apps and capabilities are all important aspects of your cell phone. Use the tips listed above to help you find and work with the right cellphone.

Tips And Tricks From The Cell Phone Gurus

Are you new when it comes to the cell phone world? Maybe you just want to upgrade? If you don't know what to look for, it is pretty intimidating. This guide will give you tips on the things you need to know about cell phones.

Avoid thinking your phone is ruined because it was dropped in liquid. The best option is to take out the battery and put it in some uncooked rice. This can absorb some moisture that is inside the phone.

You do not have to pay charges for calling information. 1-800-411-FREE is a good alternative. You will be able to get the information you need after listening to a brief advertisement.

Is your phone battery dying at speeds that seem way too fast? It's likely that your signal is low. Weak signals can drain batteries. When your phone isn't in use, keep it out of places that lack strong signals.

Carefully consider purchasing an extended warranty. These added costs are typically unnecessary. If a cellular phone is about to fail, it mostly happens on the year it is covered by its basic warranty. Also, a lot of people get new cell phones each year, so an extended warranty really isn't worth it.

Cell phones run slower with time. Thus, you might find it harder and harder to update the phone's software. This will maximize the potential of your phone. You can keep the status quo, and refuse any new updates, or upgrade your phone to a newer version.

When purchasing a brand new cell phone, be sure to take time and do your research. Invest a few hours in actually holding various models and testing their features. This is your best bet for getting home with a phone you mobile phone insurance are bound to love using.

Keep water away from your cellphone. A lot of users accidentally drop their phone into water and damage it. It is best to avoid water completely when you have your cell phone in hand. You may believe you won't drop your phone, but you can never be sure.

Don't let your phone's battery die before recharging it. These batteries should be recharged with frequency. If you let the phone go completely dead often, they won't hold a charge quite as well. Just get into the habit of doing it before it goes dead.

A case isn't needed for new phones. Smartphone designers generally incorporate a hard material, like carbon fiber or Kevlar, into the bodies during the building process. A case is good for phone protection; however, it may slow you down if you really need to use your phone. Know which choice is best for you, but make sure you base it off the type of cell phone you have.

If you would like to have the latest cell phone technology, make sure you purchase something new every couple of years. A lot of mobile websites only work properly on the newest cell phones. Therefore, you will need to upgrade as soon as you can to stay current.

Use your phone for all sorts of entertainment purposes, such as games. Smartphones are able to utilize a lot of great graphics, so you're able to play great games on the phone you have. However, too much gaming could cause issues for your memory, so be careful.

If you have a cell phone, know where you are covered before leaving on a long trip. Likely, any place close by, you'll know the coverage patterns. It might even be everywhere you go on a regular basis. However, if you're in an urban part of town and travel a lot, you may find that there is no coverage in certain places that you're trying to go.

Learn to use your phone's calender. You can use it to keep track of work or other activities. Have the phone set to alert you so you are prepared before your event. This saves both time and paper, and it keeps your life running smoothly.

Apparently, there is more to your cell phone than you thought. You have gotten off to a great start with the above advice. Review it a few times and seek out additional sources of information as well. Then you'll be able to figure out just what it is you want from cell phones.

Shopping For Cell Phones Is Easy When You Know These Tips

Cell phones are nothing new, and they are likely here to stay. Virtually everyone in modernized countries own a cell phone or know someone who does. The following tips can help you become more acquainted with them.

Be sure to restart your cellphone here and there to dispose of stored program memory from things like Facebook and Twitter. This can help your phone to perform better if you do it regularly.

If you are using LTE or 4G signal, take care when watching a video. You will usually be restricted to a certain amount of data. Video eats up this allowance quickly, which can result in higher cellphone charges. If you do end up going over, look into a new plan.

Don't think you have to rush to get a phone that's updated. Many times, it's not necessary. The updates may only be small. Make sure you read the phone reviews for the new model before you buy it to help you decide if the upgrade is really needed. If you upgraded within the last year or two, you may be okay.

If you must call information via a cell phone, note that you can call without big fees. Try dialing 1-800-411-FREE. You can get the intel you want for free with just listening to an ad.

Smartphones will slow down over time. Updating software can help to keep the phone running. Still, there is only so much you can do before you need a new phone. In a short amount of time, the upgrades might be too new for an old phone.

Before purchasing a smartphone, be absolutely certain you need one. They cost quite a bit, but they also offer many different features. The only issue is that there are lots of folks who could do with far less. If you fit into this category and you purchase a smartphone, be aware that you monthly bill will probably be higher. This just mobile phone insurance uk may not be a good choice.

Do not have your cell phone around any water. It is very common for people to damage their phones by getting them wet. For best results, keep your phone away from any water source. You may think you can prevent drops, but anything can happen.

You don't need a smartphone if you're only going to use your phone for talking. Smart phones are great for web surfing and apps, but they aren't needed for those that just need a phone for talking. You will pay far more for a smart phone so, make certain it will be worth the money.

Keep in mind that your phone's camera does not have an optical zoom. If you wish to get a nice closeup shot, you are going to have to move much closer. You can get special lenses that are made for use with a cell phone.

If you have a cell phone, know where you are covered before leaving on a long trip. Likely, any place close by, you'll know the coverage patterns. You might be covered everywhere you usually go. You may find the area you are traveling to has no coverage.

Protect your phone with a quality case. If you drop your iPhone, it could cost you a lot of money. Otterbox has several nice products that can protect your phone. Look at their Defender model.

Don't be fooled with the lens for zooming in the camera on your cell phone. A regular zoom lens that a camera is accustomed to differs from the one used in a cell phone. Cell phones use digital zooming, which enlarges pixels and degrades image quality. To get better photos, get closer to the object if you can rather than using the zoom function.

Never use your cell phone when you are on the road. This can be a major safety hazard if you do so. Avoid using your cell phone while driving.

If you do have a new phone, then you likely don't need a screen protector. There is built-in protector on many newer models. Another layer could make the screen blurry or not work right. Separate screen protectors are also prone to air bubbles and scratches of their own.

A cellular phone can do many things. It may be able to do more than you think. Use all you have learned here to get the most from your cell phone experience. This is vital because it is hard to replace these phones.

Tips For Getting More Out Of Your Cell Phone

Cell phones are everywhere, and they are here to stay. These are convenient devices that most people use every day. The following tips can help you become more acquainted with them.

If you drop your cell phone into liquid, do not assume that it is no longer any good and toss it away. Remove the battery and put the phone inside a bowl filled with rice. This pulls the moisture from the phone.

Don't waste money calling information. One way is to call 800-411-FREE. You'll get the information you're looking for after you hear a short advertisement.

The data rate speed on your smartphone will decrease over time. If you update your software, it can help to keep the phone running. That said, the updates tend to get bigger and more powerful. In a few years, upgrades can become too much for older phones to handle.

It's likely that your cell phone is used multiple times daily. Power your phone off on a regular basis. Computers and smartphones are alot alike. If you periodically restart the device, your smartphone operates more efficiently and without consuming excess memory. Simply turning your phone off a couple of times each week will improve how your phone works.

Smartphones become slower with time. With time, ordinary things like downloading your apps could possibly become cumbersome. When this begins to happen, you will need to make a decision. You can upgrade to a newer phone or refuse any updates.

As the time to purchase a newer phone approaches, shop in-store and compare prices between carriers. Take your time doing this to get the feel of various types of cell phones. This makes your chances of finding a great phone much better.

Ask the people you know for cell phone advice if you're nervous about buying one. You can trust these folks, and they will be able to share a lot of information regarding a variety of cell phones. They can offer assistance in targeting the right phone and give you the confidence to shop knowledgeably about them.

You probably won't need a case for the most modern cell phones. Smartphone manufacturers often already use hard materials such as Kevlar or even carbon fibers cheap mobile phone insurance in the cell phone construction. A case will protect the glass, but can make the phone hard to use. Make sure to understand the options provided to you.

Optical zoom is not a part of your cell phone camera's features. Move closer to the subject if you want a close-up. There are some lenses you can get that fit onto smartphones for zooming.

To stay on top of change, upgrade your phone yearly. Newer phones always work better for mobile websites. This means you will not have the best experience if you have an older phone.

If you have a cell phone, you should check out the map of coverage before you go out of town. You're probably aware of where exactly your signal is strongest near home. It could be anywhere you go regularly. If you head out of town, however, you may find that you have no reception at all between cities.

It's smart to get a sturdy case to keep your phone safe. For instance, if you drop your iPhone, it can cost you a pretty penny. Look to Otterbox for a high quality case. The top choice is the Defender, so look into it.

Don't rely on the zoom lens on your phone's camera. Many of the traditional optical zooms in cameras are not the ones used in phones. Cell phone digital zooming enlarges the pixels and degrades the quality of the image. Rather than zooming, get as close you can for better quality.

Use WiFi for watching videos, rather than the data from your data plan. Videos and movies will quickly diminish your data allotment. Of course, if your plan has unlimited data, you don't need to worry about conserving your usage.

There are many functions a cell phone can fulfill. There is probably much more to it than you realize. Use the things you learned here so you can use your cell phone to your advantage. This is prudent since cell phones are expensive technology in small packages.

The Online Shopping Advice You Have Long Wanted

Discounts are excellent for people that find them. This is an easy way to find coupons with minimal hassle. Online shopping is a great way to save money in general, but it takes some skills. Read on to learn how to maximize your savings.

Always seek a coupon code when making an online purchase. Most stores offer discounts or free shipping if you just know the special code. Google the store name and the word "coupon", and you should be able to find several. This strategy can help you save a lot of money.

Comparison shopping and bargain-hunting are integral parts of online shopping. Shopping online can make it very easy to find the best price for any items. As you comparison shop, be certain to review prices just from retails with which you are already comfortable. Even if you find that a price can't be beat, this won't matter if the site seems sketchy to you.

Always compare prices in several online stores before purchasing an item. Unless you want a specific brand or model, you should compare different products. You should choose the product that provides your necessary features, and do comparison pricing on the product. Check in with the shopping websites you trust frequently; you'll often run into new products or special savings offers.

Be on the look out for online sales as early as Tuesday or Wednesday. Because many physical stores are open on weekends, many online stores are now moving up sales days into the midweek. Great bargains in the middle of the week are yours to reap.

Be sure that all of the information about a product is read prior to making any decisions. You can be fooled by online photos of products. They can give a product a distorted size. Make sure to read the description so you know exactly what you are purchasing.

When looking for a source from which to buy something, you ought to guard against giving your information to unknown retailers. Look for security signs from Verisign or Cybertrust, so you know the retailer is not out to take your money.

Before you spend your money in a large chain store, have a look at the bulk buyers and auction websites that sell online. The deals online are typically much better than those locally. This can translate to a lot of savings and very little issues. Make sure to review their return policy, however. They differ between the retailers.

If you do lots of online shopping with a given store, think about registering with the site. This saves time during checkout and offers ways for you to save money. For example, many retailers offer special savings to their registered members. It is easier to manage your account orders and returns if you register as well.

When you shop through the Internet, try to make purchases that are not necessary right at the moment around holidays. Most retailers offer special savings on holidays such as Memorial Day, Independence Day and President's Day. Therefore, you may receive special deals and/or free shipping on the holidays.

Wait for the best deals when shopping online, don't pay retail costs. Sales are typically held on a schedule. If you are able to wait for the sale, it is possible save upwards of thirty percent or more. A little time spent waiting can really yield the best bargains and discounts.

Try several different online retailers. Different websites specialize in different types of goods. By using these specialty sites, you will be able to find exactly what you seek. The price offered will likely be the best available. In addition, you may be able to receive free shipping on the product.

Get on the mailing list for your favorite sites. You can find out before everyone else about new products or specials that are only available to newsletter subscribers. This may help you with buying products before they're sold out and planning your shopping trips to save you lots of cash.

These tips should give you the skills to lower mobile phones insurance your online shopping bills. The convenience of shopping online shouldn't come with a premium price tag. Use what you've just learned and start saving lots of money.

Iphone: It Is Not As Complicated As It Looks

Learning to integrate the various social media accounts you have with your iphone isn't as complicated as it might seem. Yet, some people aren't sure how to do this still. Never fear; this article will help you use your iphone in the best way possible.

It's important that you apply new updates to your iPhone's software and firmware whenever they're available. Updates to mobile phone insurance uk your phone protect your phone and should be installed as soon as possible. This will also backup your phone, thus storing all your important data on your computer. Should anything happen to the data on your iphone, all is not lost.

When used properly, the iphone is a useful navigational tool. Whenever you're attempting to obtain directions somewhere or find stores located along the way, the map portion of the phone can be utilized as a GPS. This can also be bookmarked so that you can go back to the spot that you were at.

Experiment with scrolling while looking at webpages. You might find it easier to scroll with one finger or two, depending on what you are looking at. Use one finger to scroll through webpages that are formatted with boxes. The two finger option will move you through the whole page.

When you are typing a message or email and don't want to use your phone's suggestions, you don't have to press X to get rid of the suggestion box. Instead, tap your screen anywhere, and instantly, the box will vanish.

It is important to update your iPhone's firmware whenever updates are available. Not only will it keep your system current and functional, it may also improve your battery life through improvements. Connecting your phone with your computer is all you need to do to update your firmware. You can also connect your iphone with iCloud to your computer.

It's easy to take steady pictures on the iphone. You can do this with your headphones by pushing the volume button. Start by steadying your hand on whatever subject you wish to capture. Press a button on the cord to take the photo.

The Calendar on your iphone is a great organizational tool. Enhanced speed and efficiency can be achieved by directly entering events instead of using the "+" function. First, change into "Day" view. Next, you can simply tap and hold any hour; a new event will automatically be created in that specific time. This quick scheduling will save you time and let you get on with your life.

Your iphone can take pictures one-handed. All you have to do is get the image into focus as you would like and then tap the button to increase the volume. This will allow you to take the picture with one hand while steadying the phone with the other hand.

If the iphone freezes up, stay calm. Attempt to unfreeze it by pressing the sleep button. The second solution is to press the home button and the sleep/wake button at the same time. Your phone will get a hard reset and, be working again in no time.

The "unread" email command isn't in plain sight, so you will have to find it. Find Details, click on Unread, and when the email is reopened, it will be seen as unread.

Use Facebook on your iphone. Lots of people do not know that it is incredibly easy to access Facebook with the iphone.

You can set up shortcuts to specific words on the iphone to be more efficient when typing. In your setting menu, navigate to General/Keyboard/Add New Shortcut. Adding shortcuts is easy. For example, if you typed a word like "probably" a lot, you could have that word auto complete after only the "pr." This inserts the word that you desire when you type in the shortcut.

In the iPhone's Mail app, you can save an email draft to send later by clicking cancel. Options will be displayed to either save, don't save or cancel. When you select the save option, your message will be placed into the Drafts folder which will allow you to continue writing your message later. If necessary, the device will create a new Drafts folder.

You feel more connected if you link your phone up with your social media accounts. Now you can stay in touch with everyone all the time! Social networks and smartphones, like the iphone, have made instant connectivity a reality.

Super Ideas On How To Have An Incredible Online Shopping Expierence

There are quite a lot of things that are convenient about getting your shopping done online. You can buy from a huge selection, find the best prices, and even shop in your pajamas! However, there are a few things that all online shoppers need to know. Keep reading for great tips about saving money online.

When considering an online store, pay close attention to the terms of service and the privacy policy. Pay special attention to how they will handle your personal information. See whether they rent or sell your data. Make sure they protect it well. If you don't like what you read in the policy, consider contacting the retailer. Do not buy anything from that store if you disagree with their policies.

Before making a purchase, go over all the item details and information. An online picture is sometimes deceiving. It can be difficult to determine the items true size. Check out the full description so that you are aware if the purchase will suit your needs.

If the results you view aren't related to familiar retailers, then you need to reconsider entering your private information. Try to find site security from Cybertrust or Verisign so you're sure that the site is legit.

Many online retailers have lots of information available about helping you become a smarter online shopper. With the wealth of choices available today, the experience of other buyers can be extremely helpful to you.

You need to understand the dispute resolution process for online auction sites. There are websites dedicated to resolving online disputes. Others simply host the transaction and are not willing to help in the case of a dispute.

Take care when setting up passwords. Avoid using phrases that are easy to guess or words that are easy. Online shopping accounts have your financial information, so you have to be especially careful. Make it as difficult as possible for would be thieves. Make a random password with numbers, letters and symbols.

Look for mobile apps for your favorite online retailers. This can be of use to you in a couple of ways. First if you aren't where you live and are somewhere that you're waiting, you can get some shopping done. Additionally, you can check out the background of items you are considering purchasing.

Register for newsletters from your favorite sellers. If you shop often at a particular website, signing up for a newsletter may give you deals that aren't offer to the general public. As a result, you can purchase products at a discount quickly before the public gets its hands on it. In addition, this will assist you in planning out your purchases in order to save the most money.

After a long, hard day, you really don't want to have to brave the crowds at the mall. Online shopping lets you shop in the serenity of your home. Try it.

The security of any Social Security number is paramount, so it should never be provided to an online retailer. If a site requests this, avoid them. To buy an item online, your SSN is absolutely not needed. Leave the site and don't look back.

When shopping online, you should always be sure that the site is gadget cover insurance a trusted seller. You're giving personal information over to them, so they better be. Untrustworthy sites may steal your identity. This can cost you a great deal of time and money.

If a site looks odd, it's best not to buy products from it. Never trust any website where you feel uneasy. If you see a lot of misspellings, or things seem fishy, get off the site. This will help you avoid giving your personal information to a scammer.

A lot of online retailers with physical stores offer shipping to said stores that is free. If a retailer has an outlet in your area, they may ship your purchase to their store for free. This will save you shipping costs. You can just visit the store and pick up your item.

Having read the information presented here, you can shop online safely and judiciously. You can shop at any time of day and benefit from the convenience. Talk to your friends about online shopping to learn more useful tips from them and perhaps share good deals and coupon codes.

Online Shopping: Make The Buying Experience Exceptional

Are coupons your thing? Are you a fanatic for flyers? Are you able to zoom in on even the most obscure bargains? Did you know you can use these same skills with online shopping? All you need is time, knowledge, and determination. To get the sort of helpful advice you need, check out the suggestions below.

Be sure to do a search for coupon codes whenever you plan compare gadget insurance to shop online. A basic search will unveil a lot of discounts offered by your favorite online retailers. Just type your store's name and the words "coupon code" to locate discounts. This is a good way to save on online purchases.

Read the terms and privacy policy of any online merchant you want to patronize. These explain to you what the site does with your information. If you disagree with these policies, talk to the merchant first. If you really don't like a policy that is on offer, then do not buy from this seller.

Take time to compare products. Unless there is a brand you really want, compare products. Select a product with the best features and price. You should return to the different online stores regularly to see new products.

Look at customer reviews for a retailer if this is your first time purchasing from them. You can usually use this as a guide as to what you can expect from the merchant's services or products. Anyone who has been rated lowly time and time again should be given a wide swerve.

If you search for a product, but only get results from unknown retailers, consider the matter strongly before passing on information. Make sure there are security signs from Cybertrust or Verisign so that you know they're not a scam.

Before adding your credit card info, pay attention to the URL. If you see "https," you can go ahead, since your data will be securely encrypted. If it doesn't, this means buying from the site will leave you vulnerable to fraud.

You can improve your searches for online retailers by only searching through sites whose only searches are for online retailers. That's not to say that using Google is a bad idea, but you could get so many results for what you're looking for that you wouldn't know where to start. A search site such as ShopStyle.com will give you the online only results that you seek.

Always review purchase details before clicking the order button. Depending on how the page is set up, getting the exact color, size and style you want can be confusing! If you double and triple check, you won't end up with something you can't use.

You can use online retailers who offer live chat. These agents can offer instant help and are much quicker that looking for details or sending emails. Depending on who the retailer is and what you're trying to purchase, you may have some luck getting free shipping or other discounts. Some of them will accommodate you if you make a purchase that day.

Online stores often offer coupon codes for connecting with them through social media or signing up to receive their emails. You may also be able to get the same reward by liking their page on Facebook.

Use your browser's bookmark option to keep up with your must-visit shopping websites. These would be the ones you shop at most often. Include any promo or coupon websites that you use during your shopping time. This helps you with just a couple clicks to find items you want from retailers you already trust.

There are online calculators that tell you just how good a particular deal really amounts to be. This goes double if you intend to take out a loan to pay for your purchase. Crunch the numbers to be certain that the deals are actually better than what else is out there. You may determine that the deal is really no better than other online shops.

Now that you're done with this article, you can see how you can benefit from shopping online. Hang onto what you've learned here and you'll soon be well on your way to some excellent bargains. Practice your online shopping skills to make yourself a veteran bargain hunter!

Tips And Tricks To Make Online Shopping Easy

Given how popular online shopping is getting, the odds are very good that you've already made an Internet purchase or two. Read the information below to get a handle on this modern phenomenon. The more you know about shopping online, the more comfortable you will be.

If you shop online frequently, be sure that your computer's anti-malware is always running and updated. Shopping sites are continually hacked by shady characters looking to steal the personal information of others. If your antivirus software issues a warning or report about the shopping site you use, do not purchase any products from the site, and report this issue to the shopping site's webmaster.

When shopping online, there is no reason to provide a social security number. No site has a reason to need this information to complete a purchase. If your number has been requested, you have likely come across a scammer's site. Spend a few extra dollars on a site that won't sell your social to the highest bidder.

Before making the first buy from someone, really look at the reviews for the company. That compare gadget insurance will show you how they operate as a retailer. Anyone who has been rated lowly time and time again should be given a wide swerve.

When searching for an item on the Internet with no results from any regular retailers, be careful entering information in them. Verisign and Cybertrust both verify and authenticate retailers so you know who to trust.

If you are paying too much money for fast shipping, try exercising some patience and use a less costly shipping service. You might be surprised at how quickly your goodies will arrive with standard shipping rates. The money saved on choosing standard shipping instead of expedited shipping may well be worth the wait.

Look for size charts on sites that sell clothes. A huge challenge in purchasing clothes online is the difficulty of determining whether or not the article of clothing fits you. But most online stores have size charts that can be used to determine the proper fit and size to buy. The services mentioned make online shopping quite painless.

Look for the security lock on your address bar to ensure the website is secure. This lock indicates that the retailer is taking all possible precautions to fully protect your personal information. Nothing is hacker-proof, but this is a helpful safety device.

Refurbished doesn't only mean fixed. It can also refer to overstock. If you find an item that's been refurbished, see if that item says if it was fixed or if the item came out of overstock. You can get excellent deals by purchasing items refurbished.

Make use of a variety of shopping sites. Each site will have its own specialties. This can narrow down your search for a product. You can also find the retailer with the best price. This cost will usually include the shipping costs.

You can find heavily discounted products at a lot of daily deal sites. Sadly, not all are truly as good as they appear. Double check that the deal is really on point - check for shipping costs, limits on use and the reputation of the actual seller.

Subscribe to the newsletter published by your favorite online merchant. If you shop at a certain website often, you will appreciate special offers that are only available by receiving their newsletter. As a result, you can purchase products at a discount quickly before the public gets its hands on it. In addition, this will assist you in planning out your purchases in order to save the most money.

If you do not know if the online deal you see is really that good, use an online calculator. Especially if the purchase is for a big ticket item involving financing. Crunch the numbers to get the best deal, especially on big purchases. You might be quite surprised at the result.

When you shop online, protect your financial information. Find websites that are secure to maximize your protection. To make sure you are on a secure site, look for the small padlock icon. Usually, this is at the top right of your browser's URL bar.

Numerous online shopping benefits are waiting for you. Online shopping is growing by the day, and it's definitely time to take part! Remember the advice that has been described so that you're able to join in the fun.

What You Must Know About Desktop Computers

Desktops are in most homes today. It gives a person top computer power, along with the ability to go online, use word processing and play games. To buy the perfect machine, check out the tips below.

Ensure your computer comes with an anti-virus program. Running without antivirus support can leave you vulnerable to malicious software invading your system. The software steals information and slows down your computer. You can use these programs to automatically scan and repair any issues that your computer is having.

If you are experiencing a sluggish desktop computer, start checking it with a boot check. You will be able to find this information in the start menu. You can see which programs start when booting the computer. Look for those that are infrequently used and change the settings so that they are not launched at every boot. This will speed up your system.

When you are building your own PC, choose the products carefully. Certain processors are sometimes only compatible with some types of motherboards. RAM won't work with all motherboards either. Whatever you purchase, make sure that things are cross-compatible. This can save you money and time, and possibly even some headaches.

If you want to get a Mac but have programs on the PC, just get Parallels for the Mac. This makes it so your Mac can run PC operating systems. Doing this allows you to work with any software or program. Do note that you must buy a PC operating system along with parallels to get this set up going.

To find the right desktop computer for your needs, start by writing down a list of what tasks you will be performing on it. Depending on your individual needs, you will need to get a computer that is the right fit for you. If you intend to do serious gaming, your hardware requirements are going to be much higher than someone who just surfs the Internet.

Diligence is essential considering how many PC makers have started skipping printing out paper documents about their systems in lieu of just posting that information online. Check their websites to determine if you will be able to get the drivers and software you need.

The computer world has changed a lot, and desktops that cheaper gadget insurance are ready-made are now cheaper than a lot of laptops. You can get a decent desktop computer for approximately $400. Make sure you buy the desktop computer from a reputable store that will guarantee the sale.

A mini PC will help you to save the environment. Mini PCs don't consume a lot power, but they have enough muscle to get most jobs done. If you mostly use computers for social media sites, e-mail, and word processing, consider this route.

Think about peripherals when buying a computer. You will require all the basics like a computer monitor, a great mouse and a keyboard. But it could be that you also need a printer and some sort of hardware for your Internet connection. Think about the other hardware that may be of need to you.

Don't go too cheap when you buy a desktop. You generally get what you paid for. Get a computer from a reputable place. A price that appears way low is likely a solid clue that things aren't as they seem. Certain independent merchants may have attractive offers, but their machines may be less than advertised or may require repair.

If you'd like to upgrade a desktop computer before you buy it, ask if this is possible as you buy the machine. Many times it will cost much less to have the seller upgrade the machine than it will to buy it and have another company do the enhancement.

The standard used to be that when you bought a computer, you also bought the monitor and printer as part of a bundle. Avoid doing this. There are many different components that get the job done. If you already own a keyboard and mouse, they work, too.

When you need to play video games or edit video, you need a very powerful desktop computer. A less-expensive and simple desktop is for you if you just need it for email or Internet purposes. You can find a computer when you know what you need.

Need Some Advice About Desktops? Read On.

It can be exciting to go shopping for your desktop computer. When you actually start looking in your local computer store at all the choices, you might begin to feel a little worried. How are you going to find the right computer for you? The following tips can help you learn what you need to know about buying a desktop computer.

Be sure to have anti-virus software. Without an antivirus program malicious software can find its way into your operating system. Such dangerous software has the ability to take personal data and also slow down the computer. For cheap gadget insurance continuous protection, you can schedule the anti virus to run and fix problems on a regular basis.

Try and find somebody who is giving away their desktop computer. Many people are getting tablets or laptops instead, and decide to sell desktops. Usually, these computers are in good shape, but before making an offer, be sure that the computer works fine.

When you build your own computer, use the right products. Some motherboards can only be used on certain processors. Certain motherboards are compatible only with certain RAM units. Make sure your pieces are cross compatible. That is going to save you money and time when you are working on your own computer.

Try buying a desktop you can afford that has only the features you need. Some people purchase models with features they will never use at a price that is more than they can afford. Be picky about what is on your desktop, and you will save money.

To be sure your desktop runs it best and that the fan is properly cooling its components, its crucial to clean the interior of your desktop one time each week. Unscrew the case to make it more efficient to dust with compressed air. Doing so keeps your computer insides clean and lets the cooling system keep the hardware at good temperatures.

Review multiple sites so that you understand what a particular machine can offer. Dealing with the many choices available can seem overwhelming, however even checking out a editor's recommended list or a couple of reviews will help you get a better computer for your money.

Only buy a computer which offers a great warranty. This just makes sure you aren't out of hundreds of dollars if something goes wrong. You will return to the store and have it fixed in this case.

If you are an avid online gamer and you want buy a computer that will give you the best playing experience, you need to keep certain things in mind. Your system needs a solid video card, no less than 4 GB in memory and a higher resolution display. Special controllers and keyboards are also available that will enhance all your gaming play.

Since lots of desktop manufacturers no longer provide lots of paper documentation, it pays to be aware of how to get the information necessary. Make sure you can find the information you need online and that it will be no issue to download software and drivers.

If you need to transfer sizable files, you probably want a writable drive. CD drives do not have the capacity to store larger media files. The DVD drive will give you the space you need. It will cost a little bit more up front, but will be worth it in the long run.

When you go to shop for your desktop, make sure you can get legal software for it. Check that it has a CD and the key to unlock the operating system, so that you won't be in trouble when you go online. You will also want to be able to install updates in the future.

If the computer's memory allocation sufficient? A desktop needs to have enough memory for the tasks you need to do. Are you planning on keeping a lot files on your hard drive? Storing pictures also takes a lot of space. These are the things to think about when shopping for the perfect computer.

Computer purchases are rarely simple, but you can make it a bit easier by studying up prior to shopping. Relax and breathe deeply, then put this new knowledge to use. You'll then be ready to make your next shopping trip a better one. Your new desktop is within your reach.

Solid Advice For Anyone Wanting To Better Understand The Iphone

If you are living in America and never heard of an iphone, you are likely the only one. This small phone has changed the world of smartphones, phone calls, and communication, in general. This article will address a few tips and hints that will help you use all the features that the iphone offers to its owner.

You can make an app out of any website that you visit insure my gadget often. To try this out, visit the site. When you get there, tap the "Go" button. You will have the choice to add a site to the home screen. Whenever you get it on the home page, it can be renamed, and then, you'll have your own app of the site.

To get rid of the AutoCorrect suggestion box, don't keep hitting the "X" button every time it doesn't recognize a word. Just tap the screen anywhere instead. This closes the box and will save you some time.

There are many useful apps available that transform your iphone into a storage device for your important files. It is easy to upload music, pictures, videos and text files. Simply connect your iphone with your computer to transfer this multimedia.

Are you unsure of how to make accented letters in messages? Here's what you have to do. Touch and hold the particular letter you want additional options for and keep your finger on it for a couple of seconds. You'll get a pop-up window with several alternative characters after a moment or two. This will allow you to type with fancy lettering as much as you want.

If you are looking for ways to make the best use of your iphone, you should look into its many media viewing features. You can use your iphone download TV series episodes, movies, funny clips or anything else you desire.

Second thoughts about something you entered in iMessage? Is Auto Correct incorrect? Simply shake the iphone and you can undo the message in an instant. Any recent typing is undone by this. Be advised that this feature is optional, so if you want it, you need to enable it in your Settings.

The iphone, as well as other smartphones, can notify you when calls or messages are received. For silent but important notifications, you can set the LED camera flash to blink when a call or message comes in. This can be accessed under the general menu under "accessibility." Then simply activate the LED Flash button to receive alerts in this way.

When you are using your iphone, you can take a screenshot. Press the home and sleep button together for taking a screenshot. You have successfully saved the screenshot to your iphone once you see your screen turn white.

You can use your Safari browser use you iphone just like a computer, even for saving images of the Internet. Just press on and hold any images you wish to save. A menu will appear asking if you'd like to save the picture to the Camera Roll. You can then put it in a message if you want.

Always keep your OS current and upgraded for the best experience on your iphone. The iphone has become as sophisticated as many computers. Occasionally, the operating system needs to have fixes and security updates downloaded to protect it. Doing this is even more important if you use your phone to transmit any kind of personal data.

A great way to save a lot of time when playing with your iphone is to set custom shortcuts for AutoText. This is a terrific feature when you often use long email addresses or typical phrases found in text messages. This shortcut feature can be accessed under the keyboard settings of your iphone.

You should not bother dealing with word corrections offered by the phone. To end this feature, simply tap your iphone screen to quit the suggestion box. This eliminates the need to tap the "x" to move from word to word.

After reading this article, you undoubtedly have a new appreciation for your iphone and all its features. Try all of the tips, and find the ones that work best for you. Your experience with the iphone will be much improved, once you have mastered the use of it!

Avoid The Lines With These Online Shopping Tips

Are you a fan of using coupons? Do you look at weekly flyers? Do you like to brag about your shopping savvy to friends and family? Were you aware that you can save a bundle by taking your smart shopping skills onto the Internet? Time, research and determination is what you need. This article will provide you with the knowledge you need.

Always update your antivirus software before doing any online shopping. Some online stores are questionable. Some folks make websites specifically for the purpose of infecting computers. It's best that you take precautions prior to visiting any stores, no matter how reputable you feel they are.

If you're looking for great coupons, try signing up with your favorite store's newsletter. New customers often get the best deals. Anyone who remains loyal will likely get even more deals, especially if they sign up for a newsletter.

Be sure that all of the information about a product is read prior to making any decisions. Simply viewing an online picture can give you a faulty impression. They can give a product a distorted size. Reading the description will allow you to be confident in the item you are purchasing.

Use caution when shopping from unfamiliar online retailers. Look for security signs from Verisign or Cybertrust, so you know the retailer is not out to take your money.

Choose another shipping offer besides expedited shipping if you find the cost to be too high. You may be shocked at how fast your items arrive using standard shipping. The money saved on choosing standard shipping instead of expedited shipping may well be worth the wait.

Take the time to look at size charts listed on all clothing websites. It can be hard to know if an item will fit properly when buying clothing online. However, you'll find that most clothing retailers online will have a sizing chart you are able to look over before buying. This can really help.

If you frequent a particular online store, create an account with them. It saves time putting your information in and you can get alerts for special deals the site offers from time to time. You might be able to receive email deals that other site guests do not receive. An account can help you track returns and orders much better than if you didn't have one.

Go carefully through the pages of any product that interests you. Check over the specifics like how large the item is and see if it includes the features you're looking for. Do remember that the product pictured may not be the exact image for what is described.

Many online shopping websites offer the buyer a wealth of information about products that may help me you shop more wisely and avoid buyer's remorse. You should ensure you are checking out online reviews from customers who personally bought the item from the retailer. These reviews can help you make the decision whether or not you should purchase the item.

Be certain you understand a store's return policy prior to buying. If you can't get your money back, you may be left disappointed.

The mall is misery after a long day at work. When you shop online, you can shop comfortably and peacefully from home. This can be an extremely relaxing way to end your day.

When you're trying to buy something, pick out a store that's on the first page when using a search engine. Sellers on the second and subsequent pages gadget cover insurance are likely less trustworthy than the initial results. It's best to shop from a popular store, especially one you've previously used.

Know about your tax liability if you're going to shop online. Only when the retailer is based in your state will you have to pay tax. If the store is based within your state, they will have to charge sales tax on your purchase. Sales tax may not show up until the final billing stage, so be mindful of this.

With this knowledge fresh in your mind, you just need to provide the opportunity to put it to use. Using the tips that have been provided, you're going to find great deals fast. Be persistent, and you can save a lot of money!

Our Tips And Tricks On Online Shopping Are Tops

Everyone wants to save a buck these days. People love taking advantage of coupons and discounts in order to save money on the items that they need. Online shopping allows you to save money while shopping from home, but you have to understand the process. Read on for some money saving strategies.

Be sure to do a search for coupon codes whenever you plan to shop online. Many online shops offer discounts for lots of things and these just require a couple minutes of searching. Search for the store name along with the word "coupon" to get excellent discounts. This makes a terrific method for saving money while online shopping.

Shop many different online sites to get the best deal possible. It can be quite easy to find just what you want at the right price online. When you shop online, only buy from merchants that you are comfortable with. Even if you find a terrific price, if ordering from a given store worries you, there is little point.

Join the mailing lists of your favorite online retailers. Frequently, stores save their best offers for first-time registrants. They will continue giving good deals to people that are interested in their brands, so signing up can lead to big savings.

Find sizing charts on any clothing site you use. One challenge about purchasing clothes online is the fact you're not sure if the items will fit. Thankfully, sizing charts will help. They can ensure you don't make a bad purchase decision.

Some sites provide tools to help you shop smarter. Reviews by people who have actually bought the product can be very helpful in making a final decision, especially when there are so many choices available.

When purchasing an item online, wait until the holidays for the best prices. Some holidays, such as President's Day and Independence Day, are huge for certain stores, including online ones. Some sites not only discount but provide free shipping too.

If you haven't noticed the little padlock in the address bar as you shop for trusted sites, start paying attention. That lock shows that the site is secure. Although nothing can be said for certain, being a little more safe never hurt anyone.

Always understand the dispute process before completing your transaction. Many websites also act as the intermediary if there is a dispute that needs to be resolved. Some sites act only as a venue and don't intervene in disputes.

Coupons.com is a great first stop before shopping. You can find coupons for manufacturers and retailers alike, all of which can save you great amounts of money. Remember to look at them before you shop to obtain the discounts.

Look for digital coupons before you purchase anything. Retail Me Not and other sites actively catalog discount codes for a lot of sites. If you are unable to find a coupon code for the website you have in mind, do a search for that website and the term "coupon code". There may be something to find out there.

See if you're able to download an app for a mobile device that is offered by a place you shop at frequently. This can come in handy in a few ways. If you are running errands and sitting somewhere, for example, you can pass the time by shopping. Additionally, you can check out the background of items you are considering purchasing.

Numerous daily-deals websites exist that assist you in obtaining large discounts on your desired products. However, there are just as many deals online that are nowhere near as good as they claim to be. Make sure you research to determine if this deal is reasonable. Check out the shipping costs, the usage limitations, and the seller's reputation before making a purchase.

Online shopping forums can really help you save a great deal of money. Other consumers will let you know when there is a great insure gadgets deal available. You might even find some products that you would not have found without them. Join shopping forums and you will benefit.

Armed with such terrific information, you ought to be ready to get started. You will understand how to get the best savings, and you can take advantage of the tremendous conveniences offered. Global reach, infinite selection, cheap prices, 24-hour access: The benefits of shopping online go on and on!

Internet Shopping Advice You Need To Be Aware Of

If you've made online purchased before, you know some of what the process entails. You need to make sure you consider everything you are about to read. You'll familiarize yourself with shopping online.

An updated antivirus program is crucial to have when shopping online. Suspect sites have included many online retailers. Some people build stores with the goal to infect your computer with malware. Take precautions before visiting any online store, even if they appear reputable.

When you are looking for places to buy a product online, and not one of the online merchants are familiar to you, you should not offer your personal information so readily. Look for Verisign or Cybertrust symbols, or do a quick search to verify the sites validity.

Only shop online from secure Internet connections. Identity thieves and hackers target public connections and wi-fi hotspots for victims.

Do you feel like you are spending too much money on expedited shipping services? If so, consider switching to standard shipping, and be patient. The speed of standard shipping just might surprise you. You can use the money you've said from using standard shipping can be put to more online purchases.

Review your online purchases before super gadget cover insurance submitting, always. It can sometimes be confusing getting sizes, colors and other things down. Go over everything in your shopping cart carefully and make sure you are buying exactly what you think you are buying.

Avoid making any purchases you really do not need right now until certain holidays. Some holidays like President's Day or July 4th have big sales online. Certain sites provide massive discounts, free shipping, or perhaps even both.

When setting up an account for an online shopping site, choose your password carefully. Do not use words or phrases that are simple to figure out. Remember that any accounts you have for online shopping are possible access points to sensitive information like credit card numbers. If you choose an easy password, hackers could easily gain access to your information. Use random passwords with letters, numbers and symbols where possible.

Look for discount codes from the manufacturer's site for an item you wish to buy. A lot of retailers will offer you a discount too, so glance over their pages prior to purchasing something. Remember that free shipping coupons can save you lots of money, especially if you make a large purchase.

Sign up for any newsletters offered by online stores. These newsletters contain information on upcoming sales, coupons and special promotions. They can help you get first choice of new items and specials on limited items and closeouts, which can mean considerable savings to you.

If you order an expensive item online, it is best to pay more for shipping so the store can send it through UPS or another reliable carrier. You may even want to pay for expedited or insured shipping. Finally, if you work long hours, ask your neighbor to watch for your package.

Shopping at the end of a season is a great way to find amazing deals online. Retailers want to get last season's merchandise out of the warehouse to make room for the current season. This means that prices will plummet.

When you shop online, be certain to safeguard all credit card data. Be certain to shop only on secure websites. To ensure you are using a secure site, verify there is an icon that looks like a padlock on the webpage. This is typically located in the URL bar of the browser.

See if HTTPS is in your browser's address bar prior to sharing any information that's personal with a company. When you see HTTPS, you know the website is secure and the information you give will be encrypted. You'll also notice an icon that looks like a padlock at the bottom of the sites you shop on to tell you they're secure.

Shopping is a pain in the neck. By doing your shopping online, it is possible to make purchases from the ease and comfort of your home. Try it.